An Overview of Companies (CSR Policy) Amendment Rules 2021

1. The Ministry of Company Affairs ‘MCA’ vide Companies (CSR Policy) Amendment

Rules 2021 shifted CSR spending mandatory from the voluntary. In this article, an attempt

has been made to cover all the amendments read with statutory provisions und

of Companies Act, 2013.

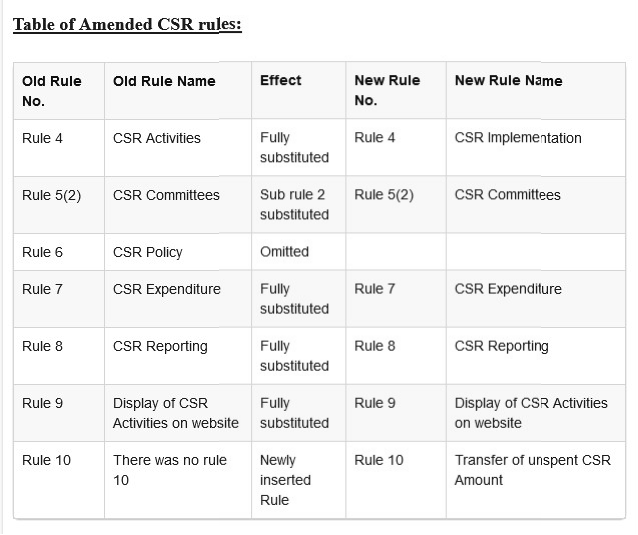

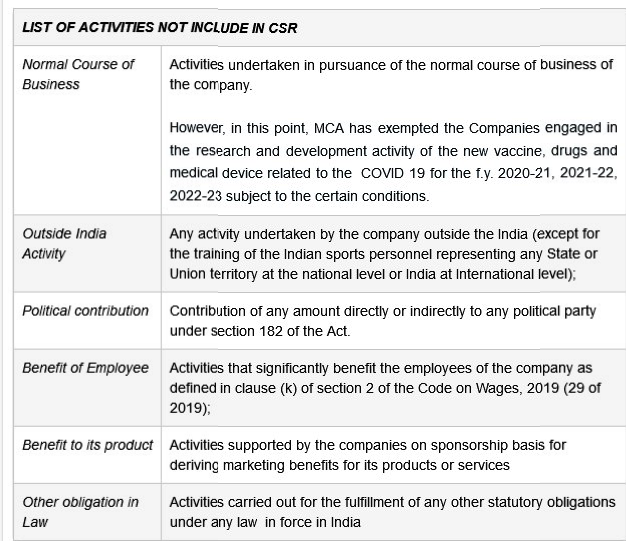

Introduction of Definition Of “Corporate Social Responsibility” List of Activities not includible in CSR

Earlier the Inclusive definition of CSR was given in the Act. Now that Inclusive definition has been amended as Exclusive definition and such Exclusive definition clearly specifies the

activities which is not considered as CSR.CSR means the activity undertaken by the company

u/s 135 read with these rules, but shall not includes the following:

UNIQUE CSR REGISTRATION NO:

Every entity who is covered under these rules, who intends to undertake any CSR activity, shall register itself with the CG by filing the e-form CSR-1 with the ROC w.e.f. 01 April 2021. On filing of CSR -1, one ‘Unique CSR Registration Number’ shall be generated by the system automatically.

From 1st April 2021, it is mandatory for every implementing agency to register itself with the ROC by filing the e-form CSR-1. If any implementing agency fails to file CSR-1, they shall not be eligible to continue as the Implementing agency.

6.5 Utilization of Fund [Rule 4(5)] The Board of a company shall satisfy itself that the funds disbursed to the entities for CSR have been utilized for the purposes and in the manner as approved by it and the Chief Financial Officer or the person responsible for financial management shall certify to the effect.

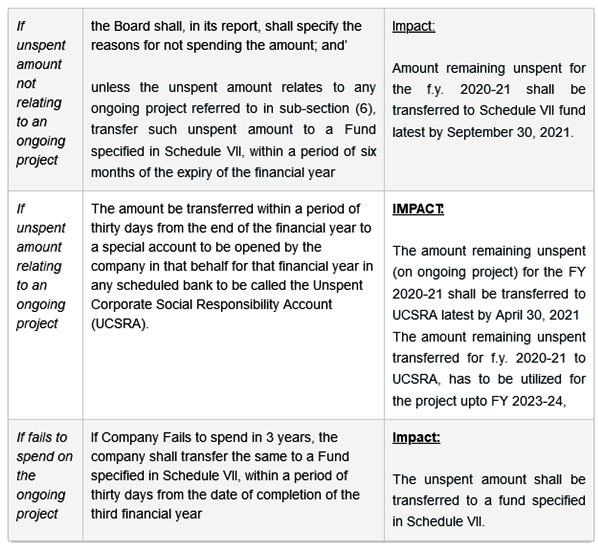

TREATMENT OF UNSPENT AMOUNT

If the Company fails to spend 2% of the Average net profit, then the following shall be the treatment of the unspent amount.

REPORTING OF CSR DISCLOSURE:

Directors Report:

The Company shall annex with its Board Report an annual report on CSR in format of Annexure-I (for f.y. 2020-21) or in Annexure II (w.e.f. fy 2021-22).

In case of a Foreign Company:

The Balance sheet filed u/s 381 shall contain ‘an annual report on CSR in the format of Annexure I

(for f.y. 2020-21) or in Annexure-II (w.e.f. fy 2021-22).

Impact Assessment: It is a new concept introduced through these rules.

A company having the obligation of spending the average CSR amount of Rs 10 Crore or more in the three immediately preceding financial years in pursuance of Section 135(5) of the Act, shall undertake impact assessment.

Impact assessment to be done by an independent agency. Impact assessment to be done in respect of CSR projects having outlays of one crore rupees or more, and which have been completed not less than one year before undertaking the impact study.

The impact assessment reports shall be placed before the Board and shall be annexed to the annual report on CSR. Impact assessment expenditure for a financial year shall not exceed five percent of the total CSR expenditure for that financial year or fifty lakh rupees, whichever is less.

Website Disclosure: (Rule 9): The Board of Directors of the Company shall mandatorily disclose the followings on its website (if any):

- Composition of CSR Committee

- CSR Policy

- Projects approved by the Board on their website.

NEW DEFINITIONS:

- CSR Policy: CSR Policy to include:

- Approach and direction given by the Board of the Company, taking into account the recommendations of its CSR Committee;

- Guiding principles for the selection, implementation and monitoring of the activities as well as the formulation of the annual action plan

- Ongoing Project: “Ongoing Project” means a multi-‐year project having timelines not exceeding three years excluding the financial year in which it was

- Project that was initially not approved as a multi-‐ year project can be made ongoing by extending the duration beyond one year by the board based on reasonable

- It appears that CSR Project’s duration cannot be more than three

- Net Profit: Net profit as per its financial statement with the applicable provisions of the Act, but doesn’t include:

- Any profit arising from any overseas branch or branches of the Company, whether operated as a separate company or otherwise; and

- Any dividend received from other companies in India, which are covered under and complying with the provisions of Section 135 of the Act.

- Net Profit for foreign Company: Net profit means the net profit of such company as per profit and loss account prepared in terms of clause (a) of sub-section(1) of Section 381, read with section 198 of the Act.

IMPLEMENTATION OF CSR SPENDING:

The CSR activities can be undertaken by the Company itself or through the followings implementing agencies

- A company established under Section 8 of the Act; or

- A Registered Public Trust; or (amended as only registered public trust)

- A Registered society

♦ Either singly or along with the other Company; or

♦ Above entity established by the Central Government or State Government; or

♦ Any of the above entity having a track record of at least 3 years in undertaking similar activities; or

♦ Any of the above entity established under an Act of parliament or a State Legislature.

Note:

- Registration under Section 12A and 80G of the Income Tax Act, 1961 become mandatory.

- Registration of such entity shall be mandatory by filing form CSR 1.

Collaboration:

A Company may also collaborate with other companies for undertakingcthe projects or programs or CSR activities subject to the conditions.

Engage International Organization:

A company may engage the international organizations for designing, monitoring and evaluation of the CSR projects or programs as per its CSR policy as well as for the capacity building of their own personnel for CSR. Only the Central Government notified organizations shall qualify as International Organization.

CSR COMMITTEE: (Rule 5(2)- Committee shall formulate and recommend to the Board, an annual action plan in pursuance to its CSR Policy, which shall include the following:

- The list of CSR projects or programmes that are approved to be undertaken in the area of Schedule VII

- Manner of the execution of such projects

- Modalities of utilization of funds and implementation of schedule for the projects

- Monitoring and reporting mechanism for the projects or programmes; and

- Details of need and impact assessment, if any, for the project undertaken by the Company.

RESPONSIBILITIES OF BOARD: (Rule 4(5-6))

- The Board shall satisfy itself that the funds so disbursed have been utilized for the purpose and in the manner as approved by it.

- The CFO or the person responsible for the financial management shall certify to the effect.

- In case of an ongoing project, the board shall monitor the implementation of the project with reference to the approved timelines and year-wise allocation and shall be competent to make modification, if any required.

By CS Jayata Agarwal

We trust you will find this insight informative as well as useful.

For any queries, you can write to us at info@sfsadvisors.co.in

Disclaimer: This insight is meant for informational purpose only and should not be considered as an advice or opinion.

Best Regards,

Team SFS